Climate Change Risk Management in Banks

The Next Paradigm

Sorozatcím: The Moorad Choudhry Global Banking Series;

-

20% KEDVEZMÉNY?

- A kedvezmény csak az 'Értesítés a kedvenc témákról' hírlevelünk címzettjeinek rendeléseire érvényes.

- Kiadói listaár EUR 74.95

-

31 793 Ft (30 279 Ft + 5% áfa)

Az ár azért becsült, mert a rendelés pillanatában nem lehet pontosan tudni, hogy a beérkezéskor milyen lesz a forint árfolyama az adott termék eredeti devizájához képest. Ha a forint romlana, kissé többet, ha javulna, kissé kevesebbet kell majd fizetnie.

- Kedvezmény(ek) 20% (cc. 6 359 Ft off)

- Discounted price 25 434 Ft (24 223 Ft + 5% áfa)

31 793 Ft

Beszerezhetőség

Becsült beszerzési idő: A Prosperónál jelenleg nincsen raktáron, de a kiadónál igen. Beszerzés kb. 3-5 hét..

A Prosperónál jelenleg nincsen raktáron.

Why don't you give exact delivery time?

A beszerzés időigényét az eddigi tapasztalatokra alapozva adjuk meg. Azért becsült, mert a terméket külföldről hozzuk be, így a kiadó kiszolgálásának pillanatnyi gyorsaságától is függ. A megadottnál gyorsabb és lassabb szállítás is elképzelhető, de mindent megteszünk, hogy Ön a lehető leghamarabb jusson hozzá a termékhez.

A termék adatai:

- Kiadás sorszáma 1

- Kiadó De Gruyter

- Megjelenés dátuma 2023. december 4.

- ISBN 9783110757910

- Kötéstípus Keménykötés

- Terjedelem325 oldal

- Méret 240x170 mm

- Súly 673 g

- Nyelv angol

- Illusztrációk 72 Illustrations, color; 33 Tables, black & white 559

Kategóriák

Hosszú leírás:

Banks, like other businesses, endeavor to drive revenue and growth, while deftly managing the risks. Dubbed the next "frontier" in risk management for financial services, climate related risks are the newest and potentially the most challenging set of risks that banks are encountering.

On the one hand, banks must show their commitment to becoming net zero and, on the other, help their customers transition to more sustainable operations, all this while managing climate-related financial risks. It is a paradigm shift from how the banking industry has traditionally managed risks as climate change risks are complex. They are multilayered, multidimensional with uncertain climate pathways that impact real economy which in turn influences the financial ecosystem in myriad ways.

Climate Change Risk Management in Banks weaves the complete lifecycle of climate risk management from strategy to disclosures, a must-read for academics, banking professionals and other stakeholders interested in understanding and managing climate change risk. It provides much-needed insights, enabling organizations to respond well to these new risks, protect their businesses, mitigate losses and enhance brand value.

Saloni Ramakrishna, an acknowledged financial industry practitioner, argues that given the uncertain and volatile climate paths, complex geopolitical patterns, and sustainability challenges, banks and business professionals will benefit from a wholistic approach to managing climate change risks. The book provides a blueprint and a cohesive framework for embracing and maintaining such an approach, in a simple and structured format.

Through her book, Ms. Saloni Ramakrishna has shared with us the essential framework required for establishing a proper climate-related risk management function. I believe her work will be a milestone in the literature on banks? climate-related risk management. --Tsuyoshi Oyama, Author; CEO, RAF Laboratory Co. Ltd.; earlier Partner, Deloitte Touche Tahmatsue; and Former Director-General of the Financial System and Bank Examination Department, Bank of Japan

The book . . . is a worthy addition to the literature of the emerging discipline of climate-related financial risk management. With this, she has moved the climate risk management dialogue beyond financial rhetoric to an actionable business proposition. -- Marc Irubétagoyena, Director of BNP Paribas; Global Head of Stress Testing and Financial Synthesis and Group Risk Board executive

With her extensive and real-world experience as a financial services industry practitioner in the risk and data management space, Ms. Saloni Ramakrishna covers the various aspects of climate-related financial risks in her signature style of simple and straightforward narrative. The book is a unique combination of real world challenges, concepts and a practical framework rolled into one. A shout-out for her focus on "the complex universe of interlinks," which is where most of the industry?s challenges will be. --Sridhar Aiyangar, Group Head, Balance Sheet and Liquidity Management, Bank ABC

Ms. Saloni Ramakrishna brings great value to this critical but young and evolving subject through a rare blend of curated content and strategic intent with real world issues and a practical approach. --Dr. Sankarshan Basu, Author; Dean of AMSOM; Professor, Indian Institute of Management, Bangalore; Ph.D. from and taught at the London School of Economics and Political Science (LSE)

Ms. Saloni Ramakrishna brings to bear her vast hands-on practitioner?s experience of advising and implementing projects for global clients, on how technology weaved intrinsically into complex risk management frameworks is a huge value multiplier. Her emphasis on the role and relevance of a well thought out, appropriately designed "Climate Information Architecture" as the bedrock of creating and perpetuating an active climate change risk management program, is spot on. --Jason Wynne, Group Vice President, Oracle Financial Services Global Business Unit; Previously Risk Technology Head of Australia & New Zealand Banking Group Limited, Australia

Több

Climate Change Risk Management in Banks: The Next Paradigm

Iratkozzon fel most és részesüljön kedvezőbb árainkból!

Feliratkozom

31 793 Ft

Freiberger Handbuch zum Baurecht

Iratkozzon fel most és részesüljön kedvezőbb árainkból!

Feliratkozom

50 610 Ft

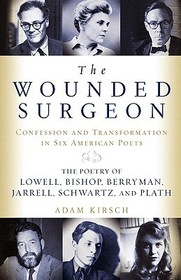

The Wounded Surgeon ? Confessions and Transformations in Six American Poets: Confessions and Transformations in Six American Poets

Iratkozzon fel most és részesüljön kedvezőbb árainkból!

Feliratkozom

10 628 Ft