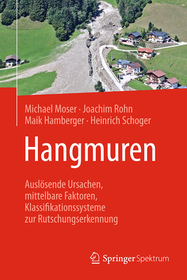

Central Bank Capital in Turbulent Times

The Risk Management Dimension of Novel Monetary Policy Instruments

Sorozatcím: Contributions to Finance and Accounting;

-

8% KEDVEZMÉNY?

- A kedvezmény csak az 'Értesítés a kedvenc témákról' hírlevelünk címzettjeinek rendeléseire érvényes.

- Kiadói listaár EUR 53.49

-

22 690 Ft (21 609 Ft + 5% áfa)

Az ár azért becsült, mert a rendelés pillanatában nem lehet pontosan tudni, hogy a beérkezéskor milyen lesz a forint árfolyama az adott termék eredeti devizájához képest. Ha a forint romlana, kissé többet, ha javulna, kissé kevesebbet kell majd fizetnie.

- Kedvezmény(ek) 8% (cc. 1 815 Ft off)

- Discounted price 20 874 Ft (19 880 Ft + 5% áfa)

22 690 Ft

Beszerezhetőség

Még nem jelent meg, de rendelhető. A megjelenéstől számított néhány héten belül megérkezik.

Why don't you give exact delivery time?

A beszerzés időigényét az eddigi tapasztalatokra alapozva adjuk meg. Azért becsült, mert a terméket külföldről hozzuk be, így a kiadó kiszolgálásának pillanatnyi gyorsaságától is függ. A megadottnál gyorsabb és lassabb szállítás is elképzelhető, de mindent megteszünk, hogy Ön a lehető leghamarabb jusson hozzá a termékhez.

A termék adatai:

- Kiadás sorszáma 2025

- Kiadó Springer

- Megjelenés dátuma 2025. május 31.

- Kötetek száma 1 pieces, Book

- ISBN 9783031735486

- Kötéstípus Keménykötés

- Terjedelem317 oldal

- Méret 235x155 mm

- Nyelv angol

- Illusztrációk 4 Illustrations, black & white; 45 Illustrations, color 700

Kategóriák

Rövid leírás:

This open access book provides a comprehensive overview of the vulnerabilities of central banks? financial accounts and the implications for central bank capital and risk management in turbulent times. By combining the perspectives of academics, risk managers and policy makers, it sheds light on the complex challenges facing central banks and offers key insights into safeguarding the stability of financial systems in an uncertain future. In an era of heightened uncertainty, central banks face unprecedented risks. Following consecutive crises, they have expanded their monetary policy toolkit through quantitative easing and credit extension, which has bloated their balance sheets and exposed them to substantial risks. Moreover, central banks are confronting novel challenges like climate change and nature loss, which threaten their objectives of price stability and financial stability. At the same time, central banks find themselves in a precarious position, as they raise interest rates to combat inflation, generating financial losses on their asset portfolios. These losses threaten to erode their capitalization, a cornerstone of central bank independence and credibility.

TöbbHosszú leírás:

This open access book provides a comprehensive overview of the vulnerabilities of central banks? financial accounts and the implications for central bank capital and risk management in turbulent times. By combining the perspectives of academics, risk managers and policy makers, it sheds light on the complex challenges facing central banks and offers key insights into safeguarding the stability of financial systems in an uncertain future. In an era of heightened uncertainty, central banks face unprecedented risks. Following consecutive crises, they have expanded their monetary policy toolkit through quantitative easing and credit extension, which has bloated their balance sheets and exposed them to substantial risks. Moreover, central banks are confronting novel challenges like climate change and nature loss, which threaten their objectives of price stability and financial stability. At the same time, central banks find themselves in a precarious position, as they raise interest rates to combat inflation, generating financial losses on their asset portfolios. These losses threaten to erode their capitalization, a cornerstone of central bank independence and credibility.

TöbbTartalomjegyzék:

Central bank capital adequacy: the simple analytics and complex politics.- Central Bank Capital and Trust in Money: Lessons from History for the Digital Age.- Accounting policies, distribution rules and the financial performance of central banks.- Fiscal Consequences of Central Bank Losses.- Central bank capital and shareholder relationship.- Consequences of Last Resort Policy for Central Bank Balance Sheets.- New Perspectives on Quantitative Easing and Central Bank Capital Policies.- Central bank capital and independence: a quantitative case study.- The impact of central bank digital currency on central bank profitability, risk taking and capital.- Impact of Transitions on the Financial Stability and LOLR Roles of Central Banks.- Through the Lens of Legal Mandate: Central Bank Capital in a Time of Climate Crisis.

Több