Cryptocurrency Compliance and Operations

Digital Assets, Blockchain and DeFi

- Publisher's listprice EUR 58.84

-

24 959 Ft (23 771 Ft + 5% VAT)

The price is estimated because at the time of ordering we do not know what conversion rates will apply to HUF / product currency when the book arrives. In case HUF is weaker, the price increases slightly, in case HUF is stronger, the price goes lower slightly.

- Discount 20% (cc. 4 992 Ft off)

- Discounted price 19 968 Ft (19 017 Ft + 5% VAT)

24 959 Ft

Availability

Estimated delivery time: In stock at the publisher, but not at Prospero's office. Delivery time approx. 3-5 weeks.

Not in stock at Prospero.

Why don't you give exact delivery time?

Delivery time is estimated on our previous experiences. We give estimations only, because we order from outside Hungary, and the delivery time mainly depends on how quickly the publisher supplies the book. Faster or slower deliveries both happen, but we do our best to supply as quickly as possible.

Product details:

- Edition number 1st ed. 2022

- Publisher Palgrave Macmillan

- Date of Publication 28 November 2022

- Number of Volumes 1 pieces, Book

- ISBN 9783030880026

- Binding Paperback

- No. of pages247 pages

- Size 235x155 mm

- Weight 409 g

- Language English

- Illustrations 1 Illustrations, black & white; 3 Illustrations, color 528

Categories

Short description:

Cryptocurrencies and digital assets are increasingly garnering interest from institutional investors. This is on top of the already strong support in place for cryptocurrencies such as Bitcoin from the retail investor. With this rapid growth has come a series of complex operational and regulatory compliance challenges. These challenges have become further exacerbated by the increasing pace of technological advances in areas such as decentralized finance (DeFi) tokenization, blockchain and distributed ledger technology (DLT) essential to the crypto and digital asset markets. This book will be the first book to provide current and practical guidance on the operational and compliance foundations of crypto investing and asset management.

The book will include:

? Step-by-step analysis of the modern operational mechanics behind cryptocurrency investment operations

? Detailed guidance and example documentation on the procedures launching a crypto fund

? Explanation of the operational procedures and compliance requirements for crytpo asset managers

? Detailed analysis of crypto anti-money laundering compliance, regulations and laws for cryptocurrencies

? Up-to-date analysis of recent crypto case studies, frauds and regulatory enforcement actions

? Review of the digital asset landscape including non-fungible tokens (NFTs) and asset tokenization

? Current examples of real-world crypto operations policies and compliance manuals

? Analysis of the emerging trends in crypto operations and compliance in areas including blockchain, DeFi,crypto lending, yield farming, crypto mining and dApps

Cryptocurrency Compliance and Operations will be an invaluable up-to-date resource for investors, fund managers, and their operations and compliance personnel as well as service providers on the implementation and management of best practice operations.?

Jason Scharfman is the Managing Partner of Corgentum Consulting, a specialist consulting firm that performs operational due diligence reviews and background investigations of fund managers of all types, including crypto asset managers, direct crypto investments, hedge funds, private equity, real estate, and long-only funds on behalf of institutional investors, including pensions, endowments, foundations, fund of funds, family offices, and high-net-worth individuals. He is recognized as one of the leading experts in the fields of digital asset and cryptocurrency compliance, fund operations and due diligence.

MoreLong description:

Cryptocurrencies and digital assets are increasingly garnering interest from institutional investors. This is on top of the already strong support in place for cryptocurrencies such as Bitcoin from the retail investor. With this rapid growth has come a series of complex operational and regulatory compliance challenges. These challenges have become further exacerbated by the increasing pace of technological advances in areas such as decentralized finance (DeFi) tokenization, blockchain and distributed ledger technology (DLT) essential to the crypto and digital asset markets. This book will be the first book to provide current and practical guidance on the operational and compliance foundations of crypto investing and asset management.

The book will include:

? Step-by-step analysis of the modern operational mechanics behind cryptocurrency investment operations

? Detailed guidance and example documentation on the procedures launching a crypto fund

? Explanation of the operational procedures and compliance requirements for crytpo asset managers

? Detailed analysis of crypto anti-money laundering compliance, regulations and laws for cryptocurrencies

? Up-to-date analysis of recent crypto case studies, frauds and regulatory enforcement actions

? Review of the digital asset landscape including non-fungible tokens (NFTs) and asset tokenization

? Current examples of real-world crypto operations policies and compliance manuals

? Analysis of the emerging trends in crypto operations and compliance in areas including blockchain, DeFi,crypto lending, yield farming, crypto mining and dApps

Cryptocurrency Compliance and Operations will be an invaluable up-to-date resource for investors, fund managers, and their operations and compliance personnel as well as service providers on the implementation and management of best practice operations.?

MoreTable of Contents:

CHAPTER 1: Introduction to Cryptocurrency Compliance and Operations.- CHAPTER 2: Procedures for Launching a Crypto Investment Fund.- CHAPTER 3: Operations for Crypto Asset Managers.- CHAPTER 4: Compliance and Governance for Crypto Asset Managers.- CHAPTER 5: Anti-Money Laundering Compliance for Cryptocurrencies.- CHAPTER 6: Crytpocurrency Regulatory Framework and Regulatory Reporting.- CHAPTER 7: Crypto Related Services and Interaction with Blockchain and Distributed Ledger Technology.- CHAPTER 8: Cryptocurrency Compliance and Operations Case Studies.- CHAPTER 9: Decentralized Finance (DeFi) Compliance and Operations.- CHAPTER 10: Investor Due Diligence on Crypto currency and digital asset investments.- CHAPTER 11: Additional crypto operations and compliance topics.- CHAPTER 12: Trends and Future Developments.

More

Cryptocurrency Compliance and Operations: Digital Assets, Blockchain and DeFi

Subcribe now and receive a favourable price.

Subscribe

24 959 HUF

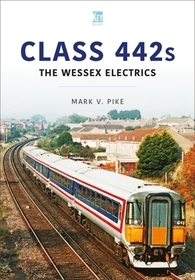

Class 442s: The Wessex Electrics

Subcribe now and receive a favourable price.

Subscribe

9 693 HUF